Demande française ou brevet français

Principe

Toute demande française ou brevet français donne lieu au paiement d’une redevance annuelle auprès de l’INPI (L612-19 CPI, alinéa 1) dès la première année. En effet, il est considéré que la première taxe est payée dans la taxe de dépôt (R613-46 CPI).

Les annuités doivent être payées au début de l’année considérée, le dernier jour du mois anniversaire du dépôt (R613-46 CPI).

Prorogation du délai de paiement

On peut se demander ce qui se passe si le dernier jour du mois anniversaire est un dimanche ou un jour férié.

Cette question est légitime, car le paiement des taxes annuelles n’est pas soumis à un délai (or l’article R618-3 CPI est seulement applicable aux délais) : elles doivent simplement être payées avant une certaine échéance fixée par les textes.

En l’espèce, les directives de l’INPI nous informent qu’il existe bien une prorogation (Directives d’examen de l’INPI, II-A 2) et que l’article R618-3 CPI est bien applicable.

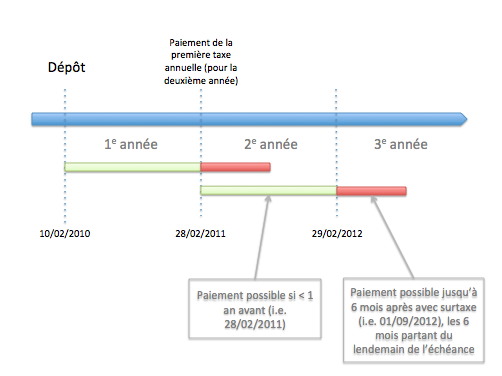

Paiement en avance

Il est possible de payer cette taxe en avance, néanmoins ce paiement ne peut pas être valablement effectué plus de 1 an en avance (R613-46 CPI).

Paiement en retard avec surtaxe

Principe

Si le paiement n’est pas effectué dans les délais, il reste possible d’effectuer le paiement dans un délai de 6 mois, sous réserve du paiement d’une surtaxe (L612-19 CPI, alinéa 2).

Normalement, l’INPI prévient le titulaire par courrier simple pour lui indiquer qu’il n’a pas payé son annuité, mais le titulaire ne peut se prévaloir d’un défaut de notification (R613-48 CPI).

Point de départ du délai de 6 mois

Pour les demandes normales

Ce délai de 6 mois part à compter du lendemain du jour de l’échéance de la redevance annuelle (R613-47 CPI), c’est-à-dire au premier jour du mois suivant.

Si jamais, l’échéance était arrivée un WE ou un jour férié (et donc que le délai avait été prorogé selon R618-3 CPI), il semblerait que la pratique de l’INPI ne fasse pas partir les 6 mois à compter de l’échéance prorogée mais seulement à compter de l’échéance normale.

Cette pratique de l’INPI ne me semble pas tout à fait cohérente avec la formulation de l’article L612-19 CPI , mais bon …

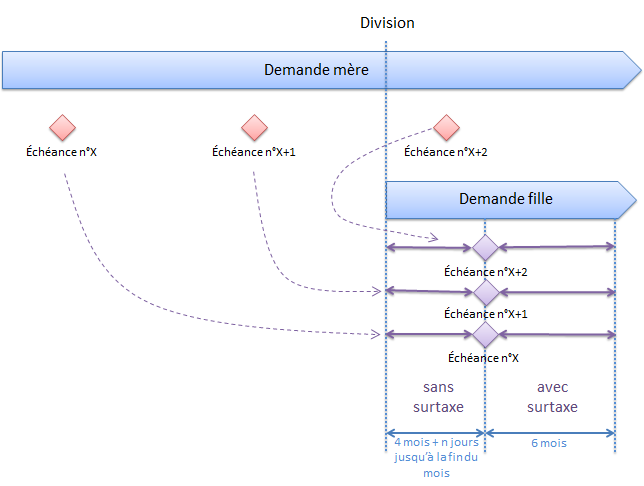

Pour les demandes divisionnaires

Pour les demandes divisionnaires (R613-47 CPI), l’INPI considère que le paiement peut être valablement effectué jusqu’au dernier jour du quatrième mois suivant la date de réception des pièces de la demande divisionnaire (Directives d’examen de l’INPI, II-A 2)

Toujours selon l’INPI (Directives d’examen de l’INPI, II-A 2), si ce paiement n’est pas intervenu dans les 4 mois précités, il peut être correctement effectué (majoré d’une redevance de retard) dans un délai de grâce de 6 mois à compter de l’expiration du délai de 4 mois.

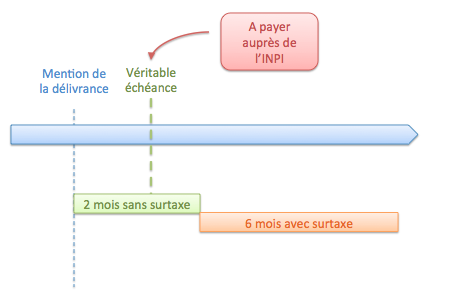

Nous avons donc le schéma de principe suivante :

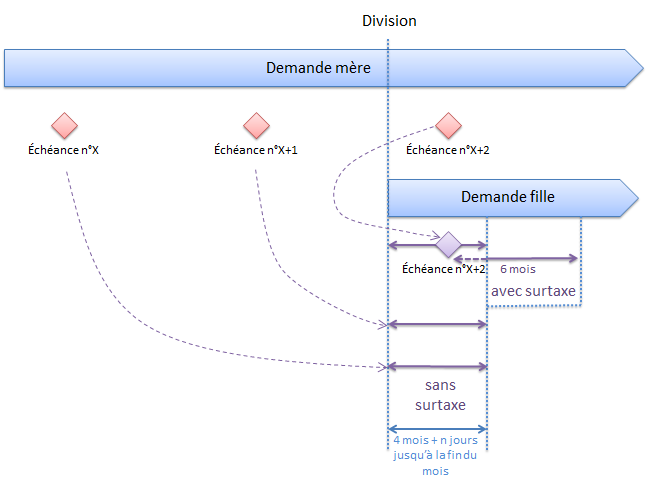

Personnellement, je suis très dubitatif devant une telle interprétation. Je ne pense pas que l’article R613-47 CPI dit autant de choses.

Si le délai de 4 mois est un délai pendant lequel le paiement » est considéré comme valablement effectué » (fiction juridique de l’article R613-47 CPI), la date d’échéance de la redevance annuelle (i.e. la date à laquelle est dû le paiement) ne me semble pas modifiée.

Ainsi, selon mon interprétation toute personnelle, le délai de 6 mois débute à la date d’échéance » normale » de l’annuité et le schéma suivant serait le schéma de principe correct :

Expiration du délai de 6 mois

Le délai de 6 mois expire le jour ayant le même quantième que la date de l’échéance de la redevance annuelle (R618-3 CPI).

Quand on parle de l’échéance, on parle de la véritable échéance, et non l’échéance éventuellement prorogée par les Directives d’examen de l’INPI, II-A 2 (enfin … cela semble être la pratique de l’office…).

Contrairement à l’Europe, rien n’indique que le délai est en fin de mois (ultimo-ultimo) : dès lors, si l’échéance était un 28 février, le délai de grâce expirera a priori le 28 août… Enfin a priori…

Montant

Le paiement s’effectue au taux en vigueur au jour de paiement (sauf si un avertissement indiquant un autre taux à été transmis au demandeur) (R613-47 CPI).

En cas de restauration, le taux applicable est celui en vigueur à la date de la restauration (R613-47 CPI).

Une réduction des redevances est accordée, jusqu’à la 7e annuité, si le titulaire de la demande de brevet ou du brevet est (L612-20 CPI) :

- une personne physique,

- une petite ou moyenne entreprise (entreprise dont le nombre de salariés est inférieur à 1000 et dont 25 % au plus du capital est détenu par une autre entité ne remplissant pas la même condition),

- un organisme à but non lucratif du secteur de l’enseignement ou de la recherche.

La réduction est de (Arrêté du 24 avril 2008 relatif aux redevances de procédures perçues par l’INPI, article 2).

- 50 % pour les redevances jusqu’à la 5e,

- 25 % pour les redevances 6 et 7,

- 0 % pour les redevances 8 à 20.

Paiement insuffisant, mais corrigé

Si une annuité est payée, mais de manière insuffisante, il est possible de corriger son paiement, sans surtaxe, dans le délai des 6 mois mentionné précédemment (R613-47 CPI, alinéa 4 et Directives d’examen de l’INPI, II-A 2).

Sanction

Le déposant/titulaire qui n’a pas payé l’annuité à la fin du délai de grâce de 6 mois est déchu de ses droits (L613-22 CPI).

Est considéré comme défaut de paiement de la redevance annuelle (Directives d’examen de l’INPI, II-A 5) :

- le non-paiement ;

- le paiement à un taux insuffisant ;

- le paiement affecté à un autre quantième d’annuité ;

- le paiement affecté à une autre demande de brevet ou à un autre brevet.

La déchéance, constatée par une décision du Directeur général de l’INPI, prend effet à la date d’échéance de l’annuité impayée (L613-22 CPI).

Pour autant, cet effet ne semble pas rétroactif puisque la Cour de cassation a indiqué que la date importante pour déterminer si un brevet était déchu était la date de la décision du Directeur général de l’INPI constatant la déchéance (C. Cass. com., 18 octobre 2011, n°10-24326) : pourquoi faire simple quand on peut faire compliqué…

Demande européenne

Aucune taxe annuelle n’est due auprès de l’INPI tant qu’aucun brevet européen n’est délivré (A86(1) CBE).

Je vous invite à regarder l’article sur le paiement des taxes annuelles en Europe pour plus de détails.

Partie française d’un brevet européen

Principe

L’INPI est compétent à compter de la mention de la délivrance du brevet (A141(1) CBE) pour percevoir les redevances annuelles.

Les dispositions précédentes pour les demandes/brevets français s’appliquent donc.

Période de transition prévue par la CBE

Pour plus de souplesse, la CBE prévoit une période de transition juste après la mention de la délivrance.

Si des taxes annuelles viennent à échéance dans les 2 mois à compter de la date à laquelle la mention de la délivrance du brevet a été publiée au Bulletin européen des brevets, ces taxes annuelles sont réputées avoir été valablement acquittées si elles l’ont été, auprès de l’INPI, dans ce délai de 2 mois (A141(2) CBE).

Bien entendu, la CBE prévoit également un délai de grâce de 6 mois pour payer les annuités (R51(2) CBE).

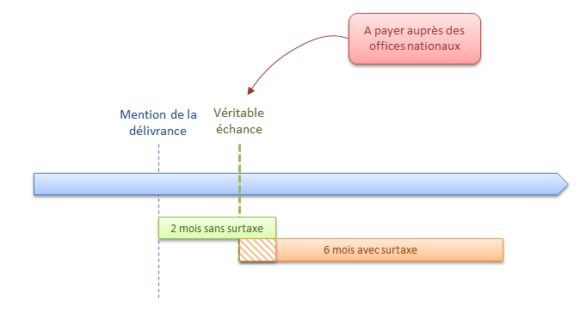

Le principe fixé par la CBE est donc le suivant :

Néanmoins, la rédaction de l’article R614-16 CPI est quelque peu différente et a soulevé quelques questions :

Lorsque le paiement d’une redevance annuelle n’a pas été effectué à l’expiration du délai visé au paragraphe 2 de l’article 141 de la convention sur le brevet européen, ladite redevance peut être valablement versée dans un délai supplémentaire de six mois, moyennant le paiement d’une redevance de retard dans le même délai

Faut-il comprendre que le délai de 6 mois ne chevauche pas le délai des 2 mois (comme indiqué ci-avant), mais s’additionne ?

Pour les magistrats, l’article R614-16 CPI (plus souple que les dispositions de la CBE) indique bien qu’il faut additionner au délai des 2 mois un nouveau délai de 6 mois (Cour d’appel de Paris, 23 septembre 2014).

Que est l’intérêt pour moi de payé la 20 me annuités d’un brevet français que je n’ai pas exploité pendant ces 19 années alors qu’il ne serra plus protégé en juin 2022 et ainsi, son exploitation je crois serra accessible puisque plus protégé Nous sommes ce mois ci en aout 2021 .

A moins bien sur qu’un autre détail sur les conséquence à venir m’échappe ? . Merci d’avance de vos réponses éclairés qui pourrait changé ce point de vue

Merci pour cet article.

Y a-t-il un délai officiel de conservation des récépissés de paiement d’annuité ?

How & who to should we pay the patent renewal fees .I have spent hours looking for methods of payment without success

What happens if a European patent is granted in less than 2 years from the filing date, e.g. 23 months from the filing date?

This means that the 3rd year renewal fee is never due at the EPO, so that Article 86(2) does not apply, since no renewal fees are paid to the EPO at all. This would seem to leave a lack of clarity as to the first renewal fee due at INPI. Must the second year FR national fee be paid on grant as well as the third year FR national fee, or only the third year fee?

Une précision concernant le point de départ du délai de grâce pour le paiement des annuités, paragraphe 1.4.2 de votre article, très bien rédigé d’ailleurs. Actuellement, la pratique de l’office français est la suivante : le point de départ du délai de grâce n’est pas prorogé lorsqu’il tombe un jour férié ou chômé. Par contre, l’échéance de ce délai peut elle-même être prorogée, selon R. 613-8 CPI. Concrètement, c’est seulement l’expiration d’un délai qui peut être prorogé et non son point de départ.