Rappel historique sur le régime des inventions de salariés

Avec la loi du 2 janvier 1968 (loi n°68-1 tendant à valoriser l’activité inventive et à modifier le régime des brevets des brevets d’invention), il n’existait aucune disposition particulière concernant les inventions de salariés (même si des dispositions existaient dans les travaux préparatoires, mais ont été retirées lors du vote).

Pendant longtemps, le juge a donc « créé » le droit afin de pouvoir traiter ce sujet complexe.

Un régime prétorien distinguait, à l’époque, les « inventions de service » (qui appartenaient conjointement à l’employeur ET au salarié) et les autres inventions (qui appartenait exclusivement au salarié).

En 1978, la loi a consacré ce régime prétorien (grosso-modo), loi qui est aujourd’hui codifiée à l’article L611-7 du code de la propriété intellectuelle.

Enfin, une rémunération supplémentaire a été rendue obligatoire (par la loi du 26 novembre 1990) pour les « inventions de missions » (notion que nous allons définir un peu plus loin… soyez patient, j’y arrive !).

Appartenance des inventions

Le principe d’appartenance des inventions

L’article L611-6 CPI dispose que le droit au brevet appartient à l’inventeur ou à son ayant cause : nous pourrions penser que l’invention d’un salarié lui appartient.

Néanmoins, et sous certaines conditions, l’employeur peut devenir l’ayant cause du salarié.

Le régime particulier pour les salariés

Selon l’article L611-7 CPI, il faut distinguer entre trois catégories d’invention pour les salariés.

Inventions de mission

Les inventions sont qualifiées d’inventions de mission lorsqu’elles sont réalisées (L611-7 CPI, point 1) :

- dans l’exécution d’un contrat de travail comportant une mission inventive (i.e. prescription de l’employeur générale et précoce) qui correspond aux missions effectives du salarié (ex. au regard de sa fiche de poste Tribunal de grande instance de Paris, Ch. 03, section 03 du 16 octobre 2001), et/ou

- dans le cadre d’études ou de recherches qui lui sont explicitement (mais pas nécessairement par écrit) confiées (Tribunal de grande instance de Paris, Ch. 03, section 03, 16 mars 2005).

Ce dernier cas est souvent plus complexe à prouver, car la prescription d’inventer faite au salarié est tardive (par exemple, au cours d’une mission) et les preuves sont plus difficiles à rassembler.

Ici, nous somme pile dans le cœur du contrat de travail : la prescription d’inventer est faite directement par l’employeur à un de ses salariés.

Dans cette situation, le droit au titre appartient à l’employeur (L611-7 CPI, point 1).

Ce droit est automatiquement attribué à l’employeur, par la loi, sans aucune action de sa part.

Inventions hors mission attribuables

Il est nécessaire ici que les inventions ne soient pas de la première catégorie et qu’elles soient réalisées (L611-7 CPI, point 2) :

- soit dans le cours d’exécution des fonctions du salarié,

- soit dans le domaine d’activité de l’entreprise,

- soit par la connaissance ou l’utilisation des moyens spécifiques de l’entreprise (le terme « spécifique » de l’article L611-7 CPI, point 2 semble exclure qu’un employeur puisse revendiquer une invention si le salarié a utilisé un stylo de l’entreprise pour écrire… ).

Ici, nous sommes à la périphérie du contrat de travail : effectivement, il n’y a pas de prescription de l’employeur pour inventer, mais il s’avère que son employé invente quelque chose.

Dans cette situation, l’employeur peut revendiquer le droit d’attribution de l’invention, mais cette attribution n’est pas automatique : il faut que l’employeur en fasse explicitement la demande (L611-7 CPI, point 2 ensemble R611-7 CPI) dans un délai de 4 mois à compter de la réception de la déclaration d’invention de la part du salarié (voir le formalisme ci-dessous).

Inventions hors mission non attribuables

Les inventions concernées par cette catégorie sont toutes les autres inventions, non concernées par les catégories ci-dessus (L611-7 CPI, point 2, première phrase).

Dans cette situation, le droit au titre appartient à l’inventeur, tout simplement.

Les inventeurs concernés

Condition n°1 : Inventeurs

Un inventeur est celui qui conçoit, imagine, et réalise l’invention.

Dès lors, la personne qui donne simplement le problème technique à résoudre (i.e. qui fixe le but à atteindre) n’est pas inventeur. Il en va de même pour celui qui exécute simplement des expérimentations.

En pratique cela peut être difficile mais des éléments de faits peuvent aider (rédaction de cahier de laboratoire, interaction avec le cabinet de PI pour la rédaction du brevet, instructions imprécises données par sa hiérarchie, C. Cass. com., 12 février 2013, n°12-12898).

Condition n°2 : Salariés

Les inventeurs concernés sont les inventeurs salariés, i.e. ceux qui ont un contrat de travail de droit français (éventuellement non-écrit) à la date de l’invention (C. Cass. soc., 2 juin 2010, n°08-70138) et qui sont soumis à une prescription hiérarchique en contrepartie d’un salaire.

Sont ainsi exclus :

- les mandataires sociaux, ou les gérants d’entreprise (non-salariés) ;

- les stagiaires (C. Cass. com., 25 avril 2006, n°04-19482) même s’ils ont signé un règlement intérieur qui prévoit une cession d’office des inventions (Conseil d’État, 4e et 5e sous-sections réunies, du 22 février 2010, n°320319).

Formalisme à respecter par le salarié pour déclarer une invention

Devoir du salarié

Comme indiqué ci-avant, l’employeur possède certains droits et il faut lui permettre de les exercer correctement.

Le salarié doit informer, immédiatement (R611-1 CPI), l’employeur par lettre recommandée avec accusé de réception (ou tout autre moyen permettant de prouver l’envoi R611-9 CPI) en lui communiquant les informations suffisantes pour permettre à l’employeur d’apprécier le classement de l’invention (R611-2 CPI) dans l’une des trois catégories d’invention que nous venons de présenter.

Accord de l’employeur

L’employeur doit prendre parti sur le classement de l’invention dans les 2 mois à compter de la réception par l’employeur de la déclaration d’invention (R611-6 CPI). À défaut, le classement est accepté.

Dans l’hypothèse où l’employeur classe cette invention comme une « invention hors mission attribuable » , il dispose de 2 mois supplémentaires (i.e. 4 mois à partir de la réception de la lettre) pour revendiquer l’attribution (R611-7 CPI).

Désaccord

Bien entendu, il est assez probable qu’en pratique, le salarié et l’employeur ne soient pas d’accord sur la classification de l’invention dans l’une des catégories. En cas de désaccord de ce type, il est possible de saisir la CNIS (commission de conciliation dite « commission nationale des inventions de salariés » créée par l’article L615-21 CPI) et dans cette hypothèse les délais évoqués ci-dessus sont suspendus (R611-8 CPI).

Conséquence d’un manquement à ce formalisme

Pour le salarié

Si le salarié ne se plie pas à ce formalisme, aucune sanction n’est prévue par le code.

Des dommages et intérêts pourront néanmoins être recherchés par l’employeur en cas d’un dépôt de brevet par son salarié à son détriment.

En tout état de cause, cela ne constitue pas une faute grave (C. Cass. soc., 15 janvier 2015, n°13-14811) pouvant justifier un licenciement.

Certains ont cherché dans la « non-déclaration » du salarié un comportement fautif privant de fait le salarié de toute rémunération supplémentaire : néanmoins, cette faute n’est pas considérée comme suffisant grave au point de priver l’inventeur de son droit à rémunération (Tribunal de Grande Instance de Paris, 3e ch., 4e sect., 30 janvier 2014, Vincent G. c. ADER Languedoc-Roussillon et al).

Pour l’invention

La Cour de cassation ajoute de plus (C. Cass. com., 18 décembre 2007, n°05-15768) que :

[… ] les formalités prescrites par les articles L. 611-7, R. 611-1 et suivants du code de la propriété intellectuelle ne sont pas prévues à peine de nullité [du brevet].

Présomption de la qualité d’inventeur

Les inventeurs mentionnés dans le brevet sont présumés être les bons inventeurs.

Néanmoins, c’est une présomption simple qui peut être renversée par la preuve du contraire (Tribunal de Grande Instance de Paris, 3e ch., 3e sect., 16 mai 2014 ; Jacques V. c. Kadant-Lamort) : ainsi si un employeur a désigné un salarié comme inventeur, il devra produire des pièces convaincantes démontrant au tribunal que ce salarié n’était, au final, pas un véritable inventeur.

Relations salarié-employeur

Information du salarié

Depuis la loi Macron du 6 août 2015, il convient d’informer le salarié (L611-7 CPI, 1°) :

- de tout dépôt d’une demande de titre de propriété intellectuelle ;

- de toute délivrance d’un titre de propriété intellectuelle.

Tensions cause d’un licenciement ?

Si souvent les conflits salariés-employeurs surviennent à la démission/licenciement/retraite du salarié, il peut arriver qu’ils surviennent durant la période d’exécution du contrat de travail.

Dans cette hypothèse, il convient de bien faire la part des choses : une demande en justice du salarié (même si elle vise à mettre à l’arrêt une chaine de production et ainsi nuire indirectement à l’employeur) ne peut constituer un motif légitime de licenciement (C. Cass. soc. 17 septembre 2014, n°13-15930), à moins que les demandes du salarié ne soient abusives.

Rémunération supplémentaire / versement d’un juste prix

La loi applicable

Un des problèmes qui se posent ici est un problème d’application de la loi dans le temps.

Par exemple, imaginons qu’une invention soit réalisée avant la loi de 1990, mais que le dépôt du brevet soit fait après cette même loi. Quelle loi appliquer ?

Pour la Cour de cassation, c’est au jour de la réalisation de l’invention qu’il faut se placer pour évaluer le régime applicable et non la date de délivrance du brevet (C. Cass. civ., 20 septembre 2011, n°10-20997).

Cette solution satisfaisante d’un point de vue intellectuelle peut néanmoins poser problème pour la preuve. Comme connaître la date exacte de réalisation de l’invention ? Il faudra alors chercher dans les échanges de mails, les réunions de travail, etc.

Fait générateur

Il est alors important de savoir à partir de quel moment est due la rémunération supplémentaire prévue par la loi :

- Au moment de l’invention ?

- Au moment du dépôt du brevet ?

- Au moment de l’exploitation de l’invention/du brevet ?

- Au moment de la délivrance du brevet ?

Les juges considèrent que les inventions visées à l’article L611-7 du CPI sont les inventions brevetables, qu’un brevet soit déposé ou non, qu’une exploitation soit réalisée ou non (C. Cass. com., 18 décembre 1984, n°83-11677, ou C. Cass. civ. ch. com., 20 septembre 2011, n°10-20997).

Les différents régimes de rémunération

Cas des inventions de missions

La loi prévoit une « rémunération supplémentaire » dans le cadre des inventions de missions (L611-7 CPI, 1°).

Il n’existe aucune définition de cette expression dans les textes et il est nécessaire de rechercher dans la jurisprudence pour se faire une opinion.

Inventions avant 1990

Avant 1990, il n’existait aucune loi imposant une rémunération supplémentaire.

Il faut donc regarder les conventions collectives :

- si une convention collective indiquait qu’il fallait fixer le montant de cette rémunération « forfaitairement en tenant compte du cadre général de recherche dans lequel s’est placée l’invention, des difficultés de la mise au point pratique, de la contribution personnelle originale de l’intéressé dans l’individualisation de l’invention elle-même et de l’intérêt commercial de celle-ci » , il faut comprendre que le montant doit être fonction des bénéfices et du chiffre d’affaire réalisé par l’employeur et ne doit pas être fonction du salaire du salarié (C. Cass. com., 21 novembre 2000, n°98-11900)

- si une convention collective indiquait qu’il faut donner au salarié « une gratification en rapport avec la valeur de l’invention » (Art 17 de l’avenant Ingénieur et Cadre de la convention collective des industries chimiques), la rémunération n’a pas lieu d’être fonction du salaire du salarié (Cour d’appel de Paris, 4e ch., sect. B du 13 mai 2005).

Inventions après 1990

Depuis 1990, la gratification supplémentaire n’est pas une option. Elle est obligatoire et doit être prévue (L611-7 CPI) :

- par les conventions collectives,

- les accords d’entreprise et/ou

- les contrats individuels de travail.

Or, il faut bien constater que de nombreuses conventions collectives ne prévoient toujours pas cette rémunération de manière systématique et que les contrats de travail sont souvent silencieux sur ce point.

Si la convention collective donne certaines conditions à cette rémunération, il faut considérer l’article en question de la convention collective comme non écrit (C. Cass. com., 22 février 2005 n°03-11027, ou C. Cass. com., 12 février 2013, n°12-12898), peu important qu’aucun brevet n’ait été déposé ou délivré.

Le juge se sentira alors libre de déterminer comme bon lui semble la rémunération supplémentaire (souvent de manière favorable au salarié, voir la section « Modalité de calcul de la rémunération supplémentaire« ).

Cas des inventions hors missions attribuables

Pour les inventions hors missions attribuables (L611-7 CPI, 2°), un « juste prix » doit être versé au salarié.

Ce juste prix doit être fixé en fonction de l’apport initial des différentes parties et de l’utilité industrielle et commerciale de l’invention (Cour d’appel de Colmar, 2e ch. civ. sect. A, du 9 janvier 2013, Affaire SNCF et L611-7 CPI, 2°).

Cas des inventions hors missions non attribuables

Dans ce dernier cas, l’invention restant la propriété de l’inventeur, aucune rémunération n’est due au salarié à ce titre.

Prescription

Durée de la prescription

La plupart des juges considère la rémunération supplémentaire est une créance salariale (C. Cass. com., 12 juin 2012, n°11-21990 ou C. Cass. com, 26 janvier 2012, n°10-13825).

La durée de prescription de ce type de créance est :

- de 5 ans pour les inventions réalisées avant le 18 juin 2008 (article 2277 (ancien) du Code civil) ;

- de 5 ans pour les inventions réalisées entre le 19 juin 2008 et le 16 juin 2013 (article 2224 du Code civil) ;

- de 3 ans pour les inventions réalisées depuis le 17 juin 2013 (L3245-1 du Code du travail).

Le point de départ de la prescription

La prescription court-elle à partir :

- De la naissance de la créance (i.e. l’invention) ?

- De la connaissance de l’exploitation de l’invention par le salarié et à partir du moment où la créance serait déterminable ?

Au regard de la jurisprudence nourrie sur le sujet (et de la nouvelle rédaction de L3245-1 du Code du travail), il semble que les partisans du début du délai de prescription au jour où la créance serait déterminable l’emportent (C. Cass. soc., 5 mai 2004, n°02-13318, C. Cass. com., 22 février 2005, n°03-11027, C. Cass. soc., 26 janvier 2012, n°10-13825, C. Cass. com., 12 juin 2012, n°11-21990).

Modalité de calcul de la rémunération supplémentaire

Système de rémunération habituelle

Aujourd’hui, de nombreuses sociétés prévoit des rémunérations supplémentaires.

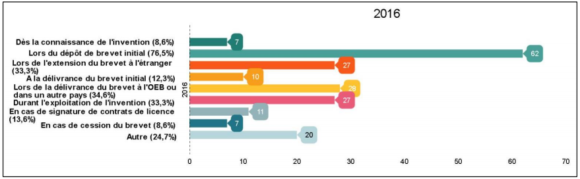

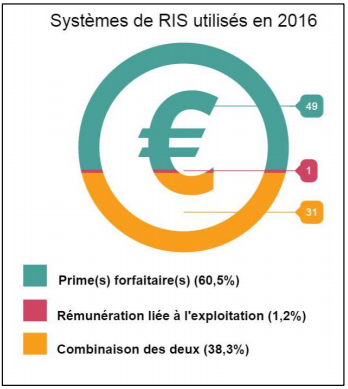

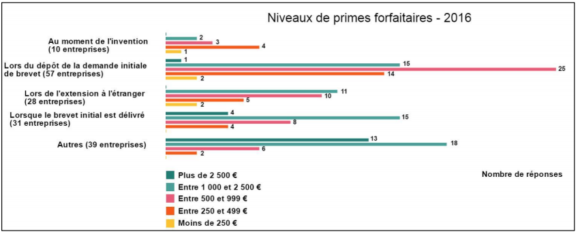

Une étude de l’INPI de 2016 donne des indicateurs intéressants pour comprendre les modalités de calcul de cette rémunération (La Rémunération des Inventions de Salariés – Pratiques en vigueur en France – Les analyses de l’Observatoire de la propriété Intellectuelle – Octobre 2016).

Je vous livre ici trois graphiques qui parlent par eux-mêmes :

Procédure préalable optionnelle : la CNIS

Si le salarié s’estime lésé (i.e. il n’a rien reçu ou pas assez selon lui), il peut choisir librement (Cour d’appel de Lyon, 1re ch. civ., sect. A, 27 septembre 2012) de saisir la CNIS ou le TGI de Paris.

Si la CNIS est saisi, le salarié disposera d’un délai d’un mois à compter de la proposition de cette dernière pour saisir le TGI (L615-21 CPI). Dans le cas contraire, la proposition de la CNIS vaudra accord définitif entre les parties.

Modalité de calcul retenu par le juge judiciaire

A défaut de pourvoir faire une synthèse des propositions de la CNIS (elles sont secrètes), nous allons faire un résumé des décisions des juges judiciaires quant aux modalités de calculs de cette rémunération supplémentaire.

Prime brevet / prime d’exploitation

Les méthodes utilisées peuvent être très variables, utilisé de manière cumulative ou alternative selon le cas d’espèce :

- détermination d’un « forfait » pour l’invention (i.e. souvent appelé « prime de brevet« ) ;

- détermination d’une prime en fonction de la réussite commerciale de l’invention et de son exploitation (i.e. souvent appelée « prime d’exploitation« ).

Montants moyens

A titre d’illustration, les juges peuvent allouer une « prime de brevet » (i.e. qui s’applique même si l’invention n’est pas exploitée) :

- [montant_epo default= »1000 € » name= »none »] (Cour d’appel de Paris, Pôle 5, 2e ch., 11 mars 2011) ;

- l’expert estime que la pratique usuel est de [montant_epo default= »500 € » name= »none »] pour le dépôt, de [montant_epo default= »500 € » name= »none »] pour une délivrance, de [montant_epo default= »1000 € » name= »none »] pour une extension (Cour d’appel de Paris, Pôle 5, 2e ch. 16 décembre 2011) ;

- [montant_epo default= »2000 € » name= »none »] (Tribunal de grande instance de Paris, 3e ch., 3e sect., 11 janvier 2013) ;

- 1 500 US$ (Cour d’appel de Paris, Pôle 5, 1re ch., 30 janvier 2013) ;

- [montant_epo default= »1000 € » name= »none »] (Cour d’appel de Paris, Pôle 5, 2e ch., 25 octobre 2013) ;

- selon une enquête de l’INPI de 2008, le montant moyen de cette prime forfaitaire est de [montant_epo default= »3000 € » name= »none »] pour le dépôt d’une demande (Cour d’appel de Paris, Pôle 5, 1re ch., 11 septembre 2013) ;

- etc.

De même, les juges peuvent allouer, au titre de la « prime d’exploitation » :

- [montant_epo default= »50000 € » name= »none »] pour un brevet FR, EP et PCT (Cour d’appel de Paris, Pôle 5, 1re ch., 14 avril 2010) ;

- de [montant_epo default= »5000 € » name= »none »] à [montant_epo default= »40000 € » name= »none »] par brevet (Cour d’appel de Toulouse, 2e ch., 2e sect., 16 mars 2010) ;

- de [montant_epo default= »4000 € » name= »none »] à [montant_epo default= »35000 € » name= »none »] par brevet (Cour d’appel de Paris, Pôle 5, 2e ch., 11 mars 2011)

- de [montant_epo default= »5000 € » name= »none »] à [montant_epo default= »10000 € » name= »none »] par brevet (Cour d’appel de Paris, Pôle 5, 1re ch., 26 juin 2013) ;

- de [montant_epo default= »2000 € » name= »none »] à [montant_epo default= »35000 € » name= »none »] par brevet (Cour d’appel de Paris, Pôle 5, 2e ch., 25 octobre 2013) ;

- selon un expert : [montant_epo default= »2000 € » name= »none »] multiplié par un coefficient multiplicateur si l’invention est un succès commercial, [montant_epo default= »1000 € » name= »none »] dans les autres cas (dans le domaine de l’électronique, Cour d’appel de Paris, Pôle 5, 2e ch. 16 décembre 2011) ;

- etc.

Il faut noter que les différences entre ces montants s’explique en partie par l’intérêt économique et le succès commercial de l’invention (il faut donc analyser la situation en fonction du cas d’espèce).

Cette « prime d’exploitation » n’est pas systématiquement prévue par les conventions collectives mais même en l’absence de convention collective, certaines décisions l’allouent quand même.

Méthode : alignement sur le régime des fonctionnaires ?

Il faut aussi noter que certains juges ont cherché à aligner la rémunération supplémentaire avec le régime applicable aux agents de l’État de l’article R611-14-1 CPI (Tribunal de Grande Instance de Paris, 3e ch. 1re sect., 10 novembre 2008).

Cette méthode a explicitement été écarté, dans une autre affaire, par la Cour d’appel de Paris, Pôle 5, 2e ch. 16 décembre 2011.

Demande de documents supplémentaires

En tout état de cause, le juge de la mise en état pourra demander à l’employeur un nombre important de documents (Tribunal de Grande Instance de Paris, 3e ch., 4e sect., ordonnance du juge de la mise en état, 15 mai 2014), éventuellement sous astreinte :

- contenu de chaque famille de brevet pour chaque invention ;

- listes des tiers détenant directement ou indirectement un droit sur une invention ou un brevet tiré de l’invention (cession, licence, apport, nantissement, garantie bancaire, etc.) ;

- copie de chaque contrat (ex. vente, licence, fourniture et contrats d’apport), portant sur tout produit couvert directement ou indirectement (ex. par fourniture de moyens), à l’une quelconque des revendications d’un brevet ;

- détail de tous les paiements reçus en rapport avec un brevet ;

- documents relatifs à la valorisation de chaque invention, notamment tous documents chiffrant sa valeur économique y compris :

- le volume des ventes,

- la marge brute,

- la marge nette,

- les économies de production

- et leur intérêt commercial.

Petit focus sur la loi applicable

Depuis le début, nous parlons des articles du code de la propriété intellectuelle régissant le droit au titre (L611-7 CPI).

Mais sont-ils réellement applicables ?

C’est un problème difficile qui relève du droit international privé.

En Europe, le règlement européen n°559/2008 ou Rome I (qui se fonde sur la convention de Rome) dispose, dans son article 8, que le contrat de travail est régi :

- par la loi choisie par les parties (sous réserve des dispositions plus favorables des autres possibilités) ;

- par la loi du pays qui présente le « plus de lien » avec le contrat de travail ;

- par la loi du pays dans lequel le contrat s’exécute habituellement ;

- à défaut, par la loi du pays de l’établissement principal de la société ayant embauché le salarié.

À vous de déterminer la loi applicable…

Effectivement, ce blog n’est pas nominatif.

Néanmoins, il n’existe aucune obligation de le faire:)

D’autant que je cite mes sources systématiquement donc cela est compliqué de faire plus factuel. (PS : je suis de plus certain que certaines personnes chez Nuss connaissent en réalité mon identité)

Concernant les mentions légales obligatoires, elles existent bien dans https://www.sedlex.fr/contact/

la présentation du sujet est synthétique et selon moi objective et impartiale. A chacun ensuite d’approfondir et de se faire conseiller. Le poste d’Andrew montre d’ailleusr qu’un salarié y a trouvé des informations utiles… Et au passage, les « officines de propriété industrielle » conseillent les salariés comme les employeurs. Seul hic, on ne sait pas qui « se cache » derrière ce site. Aucune info dans les contacts, pas de mention légale. Enfin, je n’ai rien trouvé !

@LALOUBERE Jean-Claude

Votre spam semble être rédigé en toute partialité donc je ne vais pas faire long.

Je ne pense pas trop m’avancer en disant que l’auteur de ce site est simplement du côté de la loi et que votre spam, faute d’arguments, ne reflète que la lourdeur propre à son genre.

…Et je passe outre l’absurdité de l’insulte à notre métier qui n’existerait pas sans les inventeurs.

Sedlex, comme toutes les officines de propriété industrielles, ne sont pas du coté des inventeurs. Elle est présente sur les sites Internet (Internet n’est pas public) et sur les réseaux publics pour donner une mauvaise information et tromper les inventeurs.

Sedlex, comme toutes les officines de propriété industrielles, ne sont pas du coté des inventeurs. Elle est présente sur les sites Internet (Internet n’est pas public) et sur les réseaux publics pour donner une mauvaise information et tromper les inventeurs.

@ Andrew : la prescription de 5 ans prévue par l’article 2224 du Code Civil trouvera à s’appliquer. Les questions seront :

Y a-t-il prescription de l’action en paiement de la rémunération supplémentaire ? Depuis l’origine ? Depuis le moment où l’inventeur dispose de tous les éléments ?

A quels actes la prescription s’applique par ailleurs ? A chaque vente d’un produit couvert par le brevet ? Aux bénéfices, à un pro-rata du CA ?

Autres questions : ces brevets sont-ils toujours en vigueur ? L’employeur exploite-t-il l’objet de chacun de ces brevets ? Si certains sont déchus/abandonnés, le droit à rémunération sera sans doute éteint.

Une créance (droit personnel) est peut-être ouverte pour la période de validité jusqu’à extinction de chaque brevet respectif.

Sur la question de la prescription ou non : voir le lien joint relatif à une décision récente

Bonjour,

Cet article fut pour moi une révélation.

J’ai déposé depuis 1997 plus de 12 brevets pour mon employeur.

J’ai dans mon contrat de travail une clause « mission inventive » et je considérais jusqu’à aujourd’hui que j’étais « payé » pour cela.

J’ignorais donc qu’il puisse y avoir rémunération supplémentaire.

Si je saisis demain la CNIS, que puis je faire valoir concernant les brevets déposés de 1997 à 2007 ?

Cordialement

Andrew