Demande européenne

Taxes dues auprès de l’OEB

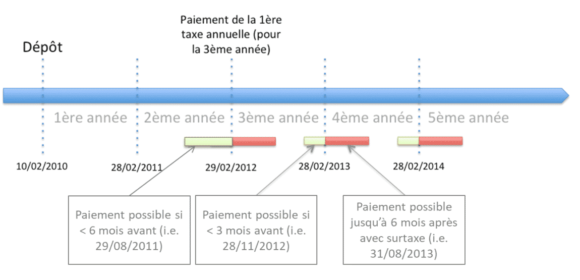

Les taxes annuelles doivent être payées à partir de la troisième année (A86(1) CBE). En effet, il est considéré que les deux premières taxes sont payées dans la taxe de dépôt.

Ces taxes doivent être payées au début de l’année considérée, le dernier jour du mois anniversaire du dépôt (R51(1) CBE).

En pratique, il convient d’ajouter deux ans à la date de dépôt et de considérer le dernier jour du mois.

N’importe qui peut payer ces taxes (Directives A-X 1).

La prorogation

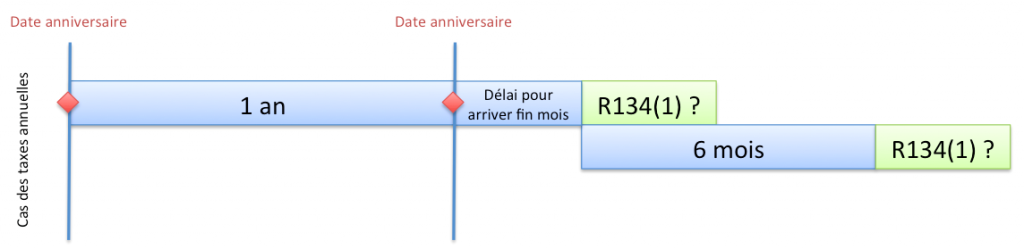

Nous pouvons nous demander si la R134(1) CBE (citée dans l’article sur le calcul des délais) est applicable.

Cette question est légitime, car le paiement des taxes annuelles n’est pas soumis à un délai : elles doivent simplement être payées avant une certaine échéance fixée par les textes.

La réponse de la jurisprudence est oui. En effet, dans une décision J4/91, la division juridique affirme :

De l’avis général, la règle 85(1) CBE est applicable par analogie dans un tel cas, ce qui est effectivement correct, bien que, si l’on s’en tient strictement à la lettre, elle ne puisse jouer en l’occurrence : une « échéance » ne saurait constituer un « délai » susceptible d’être « prorogé »

Ainsi, si une demande a été déposée le 03/03/07, alors :

- la taxe annuelle pour la cinquième année peut être payée jusqu’au 31/03/11 (jeudi), et

- la taxe annuelle pour la sixième année peut être payée jusqu’au 31/03/12 (mais le délai est prorogé en vertu de la R134(1) CBE jusqu’au 02/04/12, car le 31 mars est un samedi).

Attention néanmoins : le fait d’utiliser la R134(1) CBE (et donc payer sans surtaxe un peu plus tard) ne signifie pas que l’échéance est modifiée

Dans le cas du délai du paiement de 6 mois avec surtaxe, la situation n’est pas tout à fait identique puisque la R134(1) CBE prévoit explicitement la prorogation.

Paiement en avance

Principe

Il est possible de payer cette taxe en avance, néanmoins ce paiement ne peut pas être valablement effectué plus de 3 mois en avance (R51(1) CBE).

La pratique précédente était de tolérer en plus un petit délai supplémentaire en avance, mais cette tolérance a été supprimée des Directives.

Ce délai se calcule ultimo-ultimo (Directives A-X 5.2.4).

Cas de la troisième annuité

Il existe une exception pour la troisième annuité qui peut être payée 6 mois en avance (R51(1) CBE).

Ce délai se calcule ultimo-ultimo (Directives A-X 5.2.4).

Paiement en retard avec surtaxe

Principe

Si le paiement n’est pas effectué dans les délais, il reste possible d’effectuer le paiement dans un délai de 6 mois, sous réserve du paiement d’une surtaxe (R51(2) CBE).

Il n’est pas nécessaire de payer la taxe et la surtaxe en même temps.

Le demandeur est averti, mais il ne peut pas se prévaloir d’une omission de notification (Directives A-X 5.2.4).

En revanche, il est possible de se prévaloir d’une notification reçue, mais ne contenant pas la bonne date (J1/89).

Expiration du délai de 6 mois

Le principe de cette prolongation de 6 mois est le principe ultimo-ultimo : le délai de 6 mois vient à expiration le dernier jour du 6e mois après l’échéance (J4/91).

Ainsi, si la taxe annuelle ainsi que la surtaxe peut être payée jusqu’au 29/02/12 (sans prorogation), le délai supplémentaire de 6 mois expire le 31 août 2012 (et non le 29/08 comme on aurait pu le penser).

Point du départ du délai de 6 mois

Le point de départ de ce délai est le dernier jour du mois de la date anniversaire du dépôt de la demande de brevet européen SANS prendre en compte la R134 CBE (i.e. ce n’est pas un délai composé : la date d’expiration du délai antérieur ne constitue pas le point de départ du nouveau délai).

Ainsi, nous avons la situation suivante :

En effet, si l’on appliquait la R134 CBE, nous pourrions (J4/91) arriver à la conclusion que le délai de 6 mois est en fait un délai de 7 mois dans certain cas :

[… si ] ce délai supplémentaire ne commence pas à courir « le dernier jour » du mois, [… ] le délai supplémentaire n’expire plus à la fin du sixième mois : son expiration est reportée au septième mois, et l’on pourrait alors tomber dans l’erreur qui consisterait à appliquer à nouveau à ce septième mois le principe du dernier jour.

Montant

Le montant des taxes annuelles est progressif et est prévu à l’A2(1).4 RRT :

- pour la troisième année : [montant_epo default= »445 € » name= »A2(1).4 RRT – 3ème année »]

- pour la quatrième année : [montant_epo default= »555 € » name= »A2(1).4 RRT – 4ème année »]

- pour la cinquième année : [montant_epo default= »775 € » name= »A2(1).4 RRT – 5ème année »]

- pour la sixième année : [montant_epo default= »995 € » name= »A2(1).4 RRT – 6ème année »]

- pour la septième année : [montant_epo default= »1.105 € » name= »A2(1).4 RRT – 7ème année »]

- pour la huitième année : [montant_epo default= »1.215 € » name= »A2(1).4 RRT – 8ème année »]

- pour la neuvième année : [montant_epo default= »1.325 € » name= »A2(1).4 RRT – 9ème année »]

- pour la dixième année et chacune des années suivantes : [montant_epo default= »1.495 € » name= »A2(1).4 RRT – 10ème année et sup »]

La surtaxe est de 50 % du montant de la taxe (R51(2) CBE ensemble A2(1).5 RRT).

Remboursement

La taxe annuelle versée est remboursée si :

- la demande n’est pas en instance au jour du paiement ou si la demande n’est plus en instance à la date d’exigibilité de la taxe (Directives A-X 10.1.1, versement sans cause) ;

- le paiement est effectué plus de 3 mois avant l’échéance (voir ci-dessus sur la tolérance, Directives A-X 5.2.4).

Sanction

Principe

Si la taxe n’est pas payée (ou la taxe et la surtaxe le cas échéant) dans les délais, la demande est réputée retirée (A86(1) CBE, la date importante pour le « réputée retirée » est l’expiration du délai de 6 mois, J4/86, mais cela a été remis en cause par la décision T1402/13 qui considère que la date importante est la date de l’annuité sans le délai de grâce).

La perte de droit n’est notifiée qu’après l’expiration du délai de 6 mois.

Avant, l’OEB envoie une simple notification indiquant que le paiement peut être encore fait sous 6 mois.

Restitutio in integrum

L’A122 CBE est applicable au délai de prolongation de 6 mois, mais ne peut pas être demandé avant (ex. pour éviter de payer la surtaxe), car l’échéance n’est pas un délai.

Si le mandataire envoie plusieurs courriers recommandés à son client (celui-ci n’ayant que peu de connaissances du droit EP), malheureusement à une mauvaise adresse, la restitutio pourra être demandée (J5/13).

Fin du paiement des taxes annuelles auprès de l’OEB

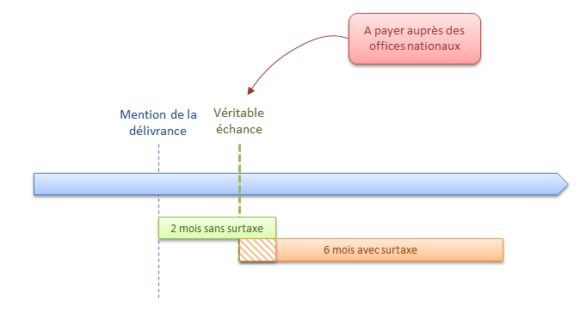

Toute année commencée avant la publication par l’OEB de la mention de la délivrance (A97(3) CBE) est due à l’OEB (A86(2) CBE).

Les années se comptent de date d’anniversaire en date d’anniversaire du dépôt de la demande (ex. du 25 juillet au 24 juillet, voir « Avis concernant le paiement des taxes annuelles pour les demandes de brevet européen et pour les brevets européens » , JO 1984, 272).

Les offices nationaux sont compétents à compter de la mention de la délivrance du brevet (A141(1) CBE).

Si des taxes annuelles viennent à échéance dans les 2 mois à compter de la date à laquelle la mention de la délivrance du brevet a été publiée au Bulletin européen des brevets, ces taxes annuelles sont réputées avoir été valablement acquittées si elles l’ont été dans ce délai de 2 mois (A141(2) CBE).

Cas particuliers

Rétablissement dans ses droits en vertu de A122 CBE

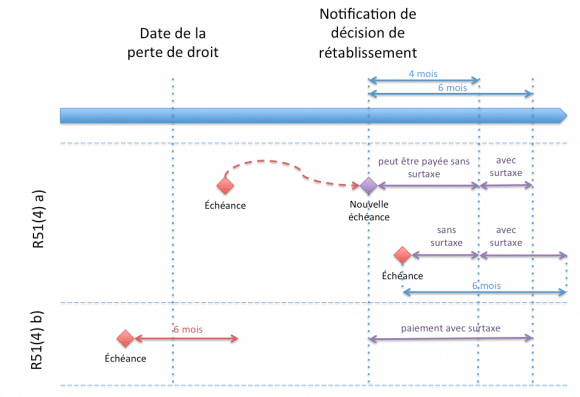

Il peut arriver qu’une échéance n’ait pas été payée pendant une période de temps où l’OEB avait considéré qu’une perte de droit s’était produite.

Bien entendu, certaines pertes de droits peuvent être rattrapées grâce aux dispositions de l’A122 CBE, comme détaillé dans cet article sur la restitutio in integrum.

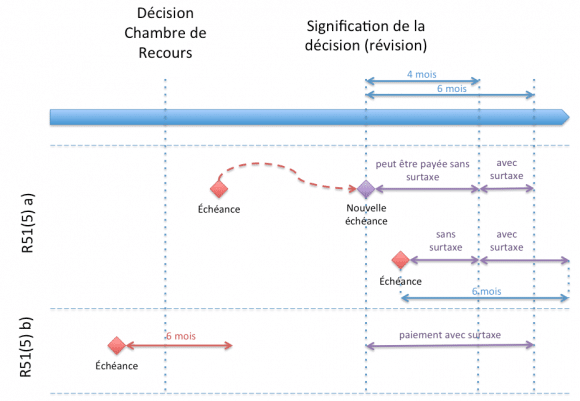

Dans cette hypothèse, il est nécessaire de payer ces annuités selon le principe détaillé (R51(4) a) CBE et R51(4) b) CBE) dans la figure suivante :

Bien entendu, la notification de la décision de rétablissement est une notification et donc les dispositions de la R126(2) CBE.

Dans le cas de la R51(4) a) CBE où l’échéance survient avant la notification de rétablissement de droit, la taxe est bien due le jour de la notification (que ce jour soit férié ou non), mais peut simplement être payée sans surtaxe durant 4 mois. Ces délais n’expirent pas nécessairement en fin de mois.

Dans le cas de la R51(4) a) CBE où l’échéance survient après la notification de rétablissement de droit, le délai de 6 mois se calcule ultimo-ultimo (J4/91 par analogie).

Cette disposition ne s’applique qu’aux demandes de brevet. En cas de restitutio sur un brevet, il faut regarder le droit national des pays pour savoir comment payer les taxes annuelles dans ceux-ci (si cela est possible… ).

Rétablissement dans ses droits suite à une révision

Le principe est assez similaire avec celui exposé pour l’A122 CBE ci-dessus :

Les mêmes remarques peuvent être faites que précédemment (cf. au-dessus).

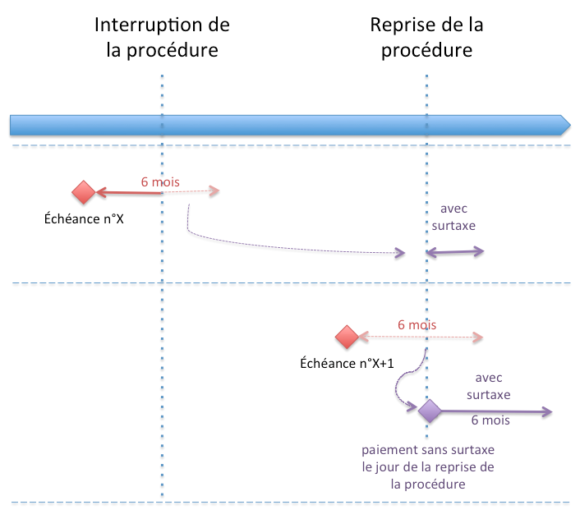

Interruption de procédure

En cas d’interruption de la procédure, nous avons vu que seul le délai de 6 mois pour payer les annuités avec surtaxe était suspendu (R142(4) CBE).

Ainsi, ce cas peut être résumé de la manière suivante :

Dans le deuxième cas présenté par la figure, le paiement peut être effectué sans surtaxe le premier jour de la reprise de la procédure (J902/87= »Décision de la Chambre de recours juridique, en date du 17 août 1987 J ../87 » , JO 1988, 323)

Demandes particulières

Bien entendu, sauf indications contraires, toutes les dispositions présentées ci-dessus sont applicables à ces cas particuliers.

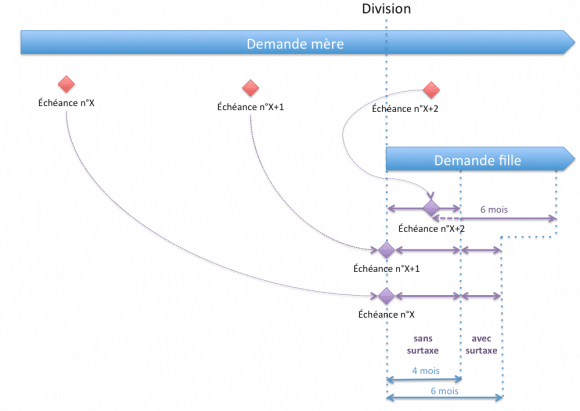

Cas d’une demande divisionnaire

Lors d’un dépôt d’une demande divisionnaire, il convient de payer une taxe correspondant (R51(3) CBE) :

- à toutes les taxes annuelles échues à la date de dépôt de la divisionnaire pour la demande mère ;

- en option, à la taxe annuelle qui viendrait à échéance dans un délai 4 mois à compter de la division.

La date importante est la date de dépôt de la demande mère (Directives A-IV 1.4.3), car c’est à partir de cette date que seront calculées les taxes annuelles de la demande fille.

Ces taxes sont dues au dépôt, mais peuvent être payées sans surtaxe dans un délai de 4 mois à compter de la division (R51(3) CBE).

De plus, ce paiement peut intervenir dans un délai de 6 mois avec surtaxe (R51(2) CBE) à compter de l’échéance, i.e. :

- la date de dépôt de la divisionnaire pour les taxes annuelles échues à la date de dépôt de la divisionnaire, ou

- la vrai date d’échéance pour la taxe annuelle qui viendrait à échéance dans un délai 4 mois à compter de la division.

L’échéance X, X+6mois, X+1, X+1+6mois n’arrive pas forcément aux fins de mois (Directives A-IV 1.4.3).

L’échéance X+2+6 mois est calculée ultimo-ultimo (analogie J4/91, Directives A-IV 1.4.3).

Le délai de 4 mois et de 6 mois bénéficie de la R134 CBE (analogie J4/91).

Cas d’une demande déposée après une personne non habilitée

Pour les cas d’une nouvelle demande déposée dans le cadre d’une « invention volée » (i.e. demande précédente déposée par une personne non habilitée), la nouvelle demande bénéficie de la date de la demande précédente (A61(1) CBE ensemble A76(1) CBE).

Néanmoins, contrairement aux demandes divisionnaires, les taxes annuelles déjà échues pour la demande précédente ne sont pas dues (R51(6) CBE).

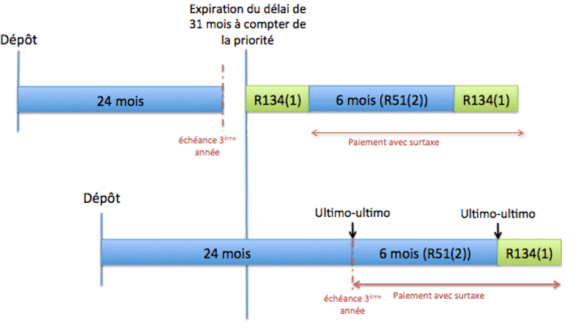

Cas de la 3e taxe annuelle pour les demandes EuroPCT

Principe

La taxe annuelle due pour la 3e année doit être payée dans le délai de 31 mois à compter de la priorité (R159(1) g) CBE) si cette échéance est arrivée à son terme.

Ainsi, aucune taxe n’est due :

- si la demande internationale est une demande sous priorité ;

- si l’écart de temps entre le dépôt de la demande prioritaire et le dépôt de la demande internationale est supérieur à 7 mois.

Cas de l’entrée en phase anticipée

En cas d’entrée en phase anticipée, on peut se poser la question de savoir si on doit payer la taxe annuelle dans le « délai » véritable (i.e. 2 ans) ou dans le délai de 31 mois.

Pour faire simple, c’est bien le délai de 31 mois qui sera le délai maximal : en effet, l’OEB ne considérera pas une demande d’entrée en phase comme valide tant que la taxe annuelle n’aura pas été payée (Directives A-X 5.2.4).

Surtaxe en cas de retard

Si la 3e annuité n’est pas payée dans les délais, elle peut encore être payée avec surtaxe dans un délai de 6 mois (R51(2) CBE).

Dans l’hypothèse où l’échéance de paiement de la troisième annuité a expiré, le délai de 31 mois fait partir le délai de paiement avec surtaxe (en prolongeant le délai de 31 mois s’il tombe un jour de fermeture pour un des bureaux de l’OEB, car c’est un délai composé J1/89 et Directives A-X 5.2.4).

Dans l’hypothèse où l’échéance de paiement de la troisième annuité n’a pas encore expiré, le calcul du délai de 6 mois se fait comme d’habitude, c’est-à-dire en utilisant le principe « ultimo-ultimo » décrit ci-dessus.

Si la taxe annuelle n’est toujours pas payée, la demande est réputée retirée (A153(2) CBE ensemble A86(1) CBE).

Seul l’A122 CBE est applicable au délai de 6 mois.

Bonjour,

Pour le paiement de mes annuités ,je passais par un cabinet expert depuis des années.Cependant pour cette année je n’ai pas de nouvelles .Comment et ou dois je payer en direct ?

De plus ayant eu des manques de moyens financiers l’année dernière je n’ai pu honorer toutes mes annuités des 12 pays que j’avais choisi et n’en ai honoré que dans 3 . il m’avait été dit que c’était perdu définitivement .Apparemment il est possible de ré-ouvrir ses droits ? Je vous remercie par avance de votre aide.

Recevez mes sincères salutations